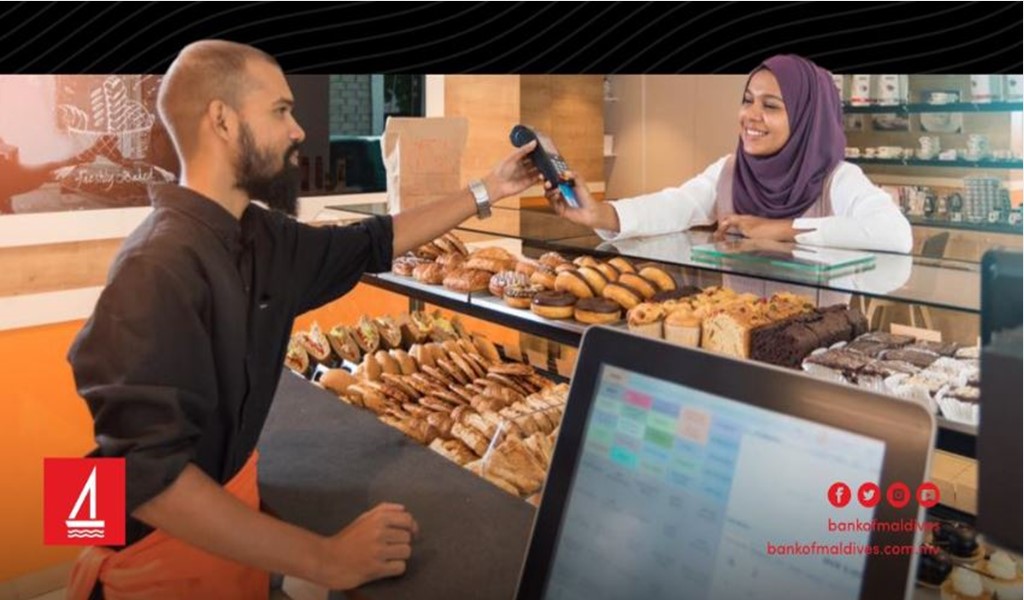

Rules Have Been Relaxed by the Bank of Maldives On Their Retailers’ Loan Scheme!

We have been keeping a close eye on the latest new updates from Bank of Maldives Plc (BML) as they have been bringing major changes to their loans and financing schemes at a speedy pace. On 1

Today, they have announced positive changes brought to its Retailers’ Loan Scheme’s eligibility criteria. Previously, businesses must have had to attain a revenue of MVR 50,000 via their POS during a continuous period of 12 months to qualify for the loan. With the current changes the revenue amount has been decreased to MVR 30,000 and the time period to 6 months. In addition to this, the bank will be omitting the months in which businesses experienced the greatest losses this year due to the impacts of COVID-19 pandemic being from April to June.

The Bank’s Retailers’ Loan Scheme aims to aid businesses finance their day-to-day requirement for the smooth run of the business as well as for plans of expansions. Businesses can be issued loans up to three times of the amount of revenue they have attained via POS during a set period.

BML reports that the changes have been brought lighten the financial burden on its customers during a very financially difficult time period faced due to the ongoing pandemic.