President Ratifies Statistics Act, Bill Of Small And Medium Sized Businesses, And Income Tax.

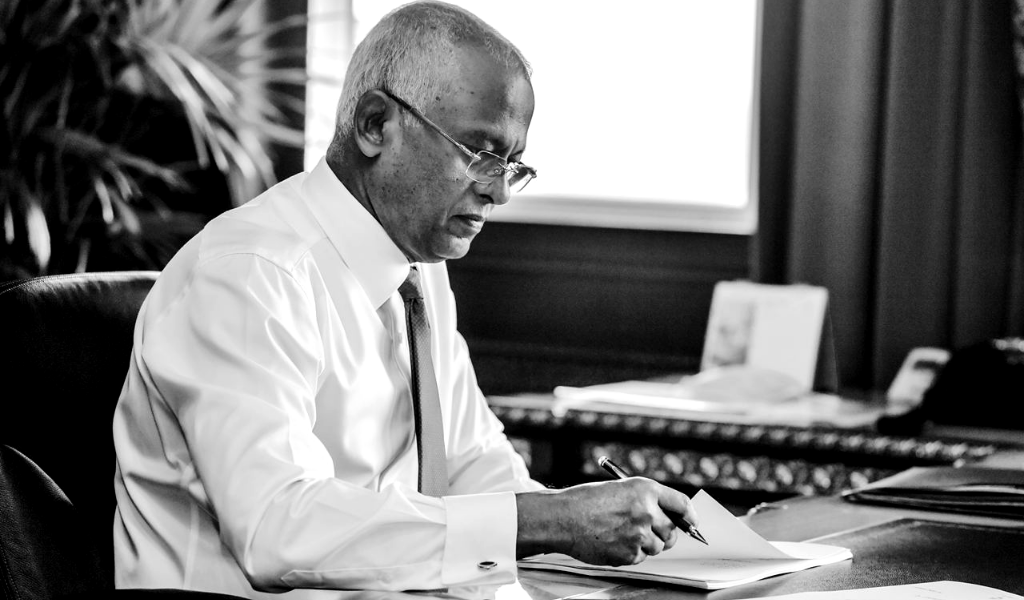

President Ibrahim Mohamed Solih has ratified Maldives Statistics act, the First Amendment bill to the Small and Medium Enterprises and the first amendment bill to the Income Tax Act.

The Maldives Statistics Act lays out the guidelines , under an established national standard. The law aims to promote the country’s statistical industry and collect relevant data on the Maldives economic, ecological and social aspects, and to use these data responsibly for the benefit of all citizens.

The amendment requires the establishment of a 100% government-owned entity, which would now be called as the "Business Center Company" (BCC). BCC will monitor whether the policies and plans implemented in accordance with the Act comply with the intent and scope of the Act and create a suitable environment for the prosperity of small and medium-sized businesses.

The amendment to the Income Tax Law adopted today includes the imposition of an income tax on temporary residents of the Maldives who earn a salary. It also details the calculation of employee withholding tax and special exemptions granted when paying income tax, as well as additional details that provide additional details for the Income Tax Act.

Once approved, the amendment has been published in the official gazette and is now in effect.